New Zealand’s aged care sector is under threat. How do we find sustainable, long-term solutions for the industry?

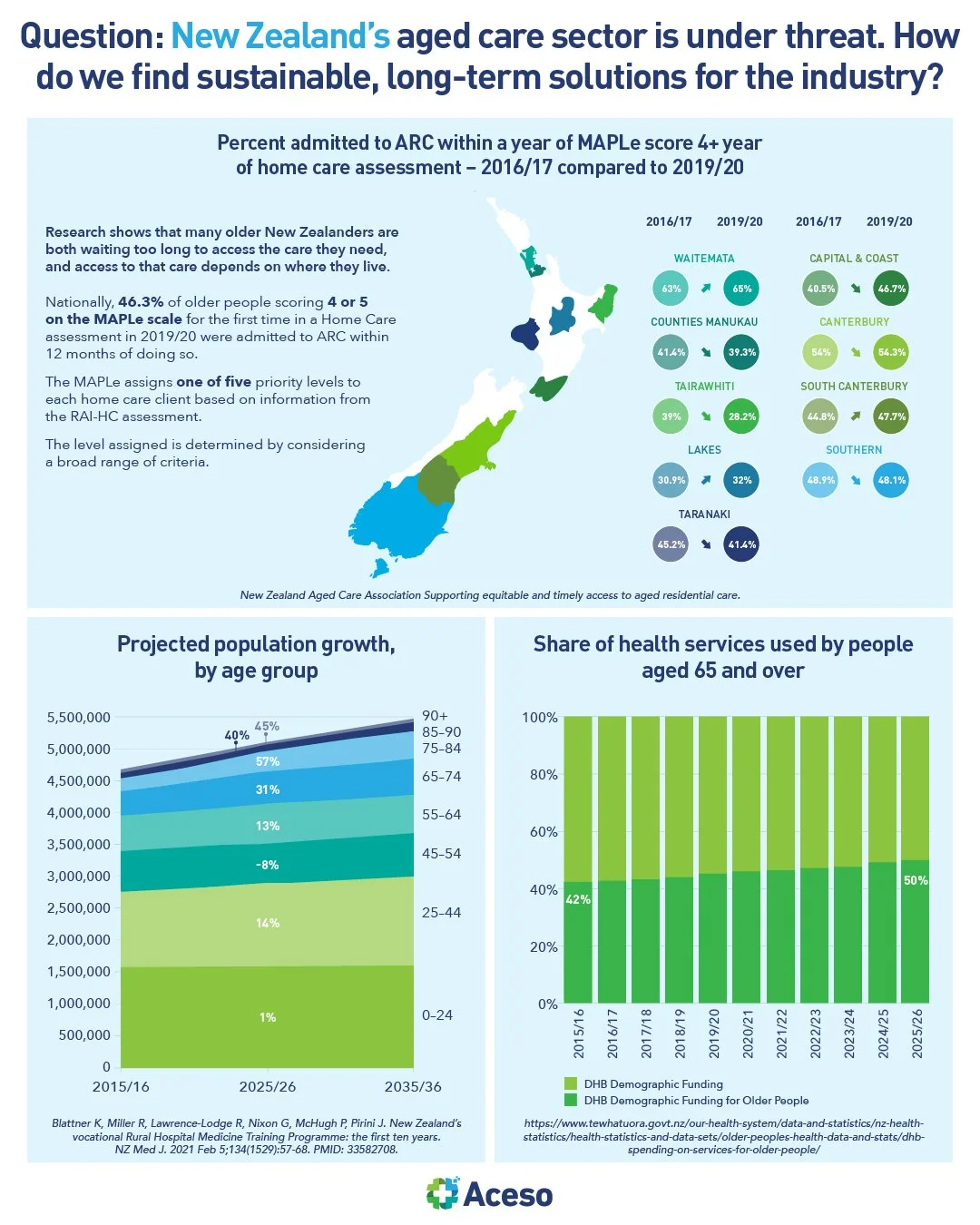

The adequacy of New Zealand's aged care sector to look after an ageing population has come under question due to chronic staffing and funding concerns.

Aged residential care is part of the continuum of health services available to people over 65. The services generally situate between and overlap with home support/community nursing and public hospital care. Currently, around 40,000 New Zealand residents (compared to the public health system’s 14,000 odd beds) live in around 670 private facilities around the country. There are four defined levels of care (rest home, dementia, continuing hospital, and psycho-geriatric) with differences in funding, certification requirements, and contractual obligations. In 2017/18 expenditure on aged residential care expenditure was around $1.9 billion per year, with DHBs spending around $1.1b and residents through a legislated financial means test of income and assets contributing $0.8b.

Aged residential care organisations have long complained that chronic underfunding from central government has seen the sector shrink. We are seeing more closures of older smaller private and charitable facilities, especially in rural areas. We also have a lot of rundown residential stock because the funding model does not incentivise renovations, upgrades or new developments. Bed subsidy rates are based on local authority land costs that have not kept pace with rising land values. Reports indicate that aged care providers get an average of $250 a day in government funding for a hospital level bed to cover, compared with $1000 a day for a public hospital bed. To compound matters, incentives are lacking to encourage investment in strategically important but otherwise 'uneconomic' locations.

Despite predicted demand for more than 15,000 new beds by the end of the decade, the number of beds actually available shrank by more than 1200 in 2022. Any aged care beds currently being built are largely coming from large retirement village operators. These retirement villages and aged residential care are funded completely differently. Retirement village prices and costs are set by the provider and are market driven.

New Zealand is not alone in facing an ageing population dynamic and difficulties in meeting the workforce required for aged residential care. It is of sufficient policy concern that the OECD has a Long Term Care work programme to address related policy concerns. According to experts, the sector is doing everything it can to maintain viability, however we will need to revisit the funding model, revisit how to address the workforce shortages and commit funding over many years, to find sustainable long-term solutions for the industry.